In this post we will talk about what is Salesforce Financial Services Cloud (FSC) and Top 5 Reasons why Financial Services Companies should implement Financial Services Cloud instead of Sales Cloud or Service Cloud.

What is Salesforce Financial Services Cloud?

Salesforce Financial Service Cloud (FSC) is industry specific offering from Salesforce with out of the box workflows and data model specific to Financial Services Industry. FSC caters to three important Financial Services verticals as listed in table below.

Table: Salesforce Financial Services Cloud Verticals

| Wealth and Asset management | Private Banks Registered Investment Advisors |

| Banking | B2B B2C |

| Insurance | Life and Annuities Property & Casualty |

Financial Services Cloud Vs Sales Cloud vs Service Cloud

Top 5 Reasons why Financial Services Companies should implement Financial Services Cloud instead of Sales Cloud or Service Cloud

1. Financial Services Industry Data Model

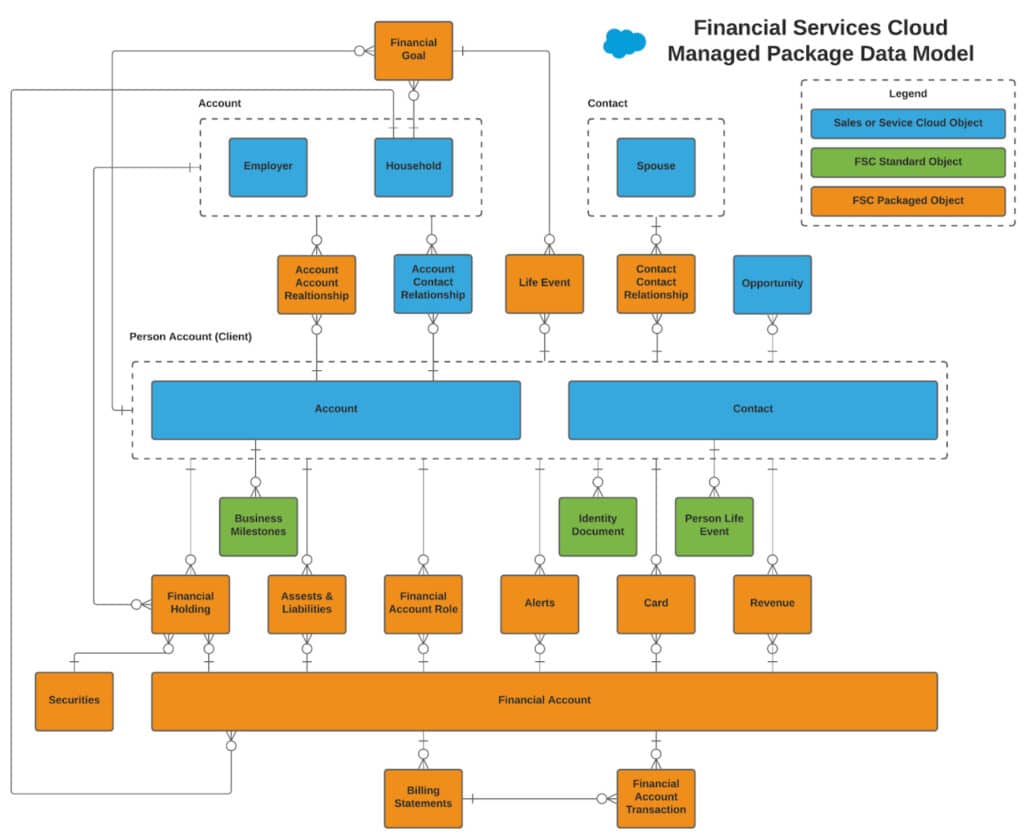

If you are implementing Sales or Service Cloud for Financial Services customers you will have to design a custom data model to represent entities in the financial sector. Building a data model from ground up will be a significant effort. Financial Service Cloud comes with OOB structured and flexible data models specific to the Financial Services Industry.

Financial Services Cloud data model includes:

- Sales and Service Cloud Standard Objects

- FSC Standard Objects

- FSC Packaged Objects

The above Diagram shows the Managed Package Data Model. Apart from this FSC also comes with following data models

- Insurance Data Model

- Interaction Summaries Data Model

- Financial Deal Data Model

- Mortgage Data Model

- Action Plans Data Model

- Consent Data Model

2. Quickly Implement Industry Workflows

FSC comes with pre-assembled flows for the Financial Services Industry. Customers can make appropriate changes to these flows to tailor it to their specific needs and quickly go live instead of spending months developing custom processes. Some of the available OOB flows are listed below.

Table: Flows for Retail Banking

| Activate Card | Activate a new debit or credit card linked witha financial account. |

| Close Account | Close a financial account. |

| Issue New Card | Issue a new card for a financial account and send it to the customer’s billing or shipping address. |

| Update Address | Change the address associated with a financial account. |

| Order Checks | Send checks for a financial account to the customer’s billing or shipping address. |

Table: Flows for Insurance

| Initiate FNOL | Initiate the first notification of loss for an insurance policy. |

| Add Beneficiary to Policy | Add a beneficiary to a life or home insurance policy. |

| Add Driver to Auto Policy | Add a driver to an auto insurance policy. |

| Cancel Policy | Cancel an insurance policy. |

| Update Premium Payment Method | Change the current method or add a method for paying the premium of an insurance policy. |

3. Access Actionable Information at a Glance

Financial Services Cloud comes with several OOB Features which helps users find information that they need with minimum clicks. Some of the User productivity features are listed below.

Table: User Productivity Features

| Relationship Maps | Directly associate businesses and legal entities, such as trusts, to households and groups. |

| Actionable Relationship Center | Visual representation of your customer’s relationships. Explore deeper levels of connection and quickly take specific actions from one screen. |

| Life Events and Business Milestones | Get an at-a-glance view of your customer’s life events or business milestones |

| Action Plans | Capture repeatable tasks and automatically assign task owners and deadlines. |

| Alerts | Get timely alerts about clients and act as necessary. |

4. Stay Compliant with Industry Regulations

Financial Service is one of the highly regulated industries and these regulations are ever changing. FSC comes with several features to help customers stay compliant.

Table: Financial Services Cloud Key Compliance Related Features

| Compliant Data Sharing | Lets administrators and compliance managers configure advanced data sharing rules, so that they can improve compliance with regulations and company policies. |

| Intelligent Document Automation for Consent and Disclosures | Manage consent and disclosure documents, generate authorization request forms, and track user responses. |

| Interaction Summaries | Manage client and partner interactions and take advantage of structured note-taking and compliant, role-based data sharing options. |

| Financial Deal Management | Deal teams can manage every aspect of deal-related information and take advantage of compliant, role-based data sharing options. |

Image: Interaction Summaries

5. Empower Agents and Customers

Financial Services Cloud Managed Package comes with feature-rich portals to share key financial data with your customers and agents.

Table: FSC Experience Cloud Sites

| Insurance Agent Portal | Insurance Agent Console. 360-degree view of Policyholders. |

| Financial Services Client Portal | Create a self-guided loan application and financial account experience for your customers. |

Image: Financial Services Client Portal

Salesforce Financial Services Cloud Video

Summary

Apart from the features discussed above Financial Service Cloud comes with several other features such as Intelligent Need-Based Referrals and Scoring, Intelligent Form Reader, Rollups by Lookup specially made for the Financial Services Industry making Financial Service Cloud preferred choice over Sales or Service Cloud for a Financial Service Customer.

HI Amit,

Can you please let me know when can I expect the full release of the playlist for Financial Cloud.

Hello,

My client is looking for a Salesforce Financial Cloud trainer. Need to train their employees for one month or so. Daily 1 / 2 hour sessions would be fine. Kindly let me know your availability and interest to proceed further.