How to Do QuickBooks to Salesforce Integration: A Step-by-Step Integration Guide

Why Connect QuickBooks with Salesforce?

Have you noticed delays when payment details in QuickBooks aren’t yet reflected in Salesforce? For example, an accountant may update a payment in QuickBooks and then either manually enter the same information in Salesforce or provide a sheet with the updated details for someone else to make the changes. During the communication between different teams, some important details could be missed. And moving information manually between systems adds extra steps that slow down routine processes and take valuable time.

Do you know how much time is spent switching between apps? According to a study by Atlassian, it can take up to 9.5 minutes to get back into a workflow after switching between digital apps. Nearly half of workers say that switching between different tools drains their productivity. The impact is even greater when people have to change tasks and topics many times during the same day.

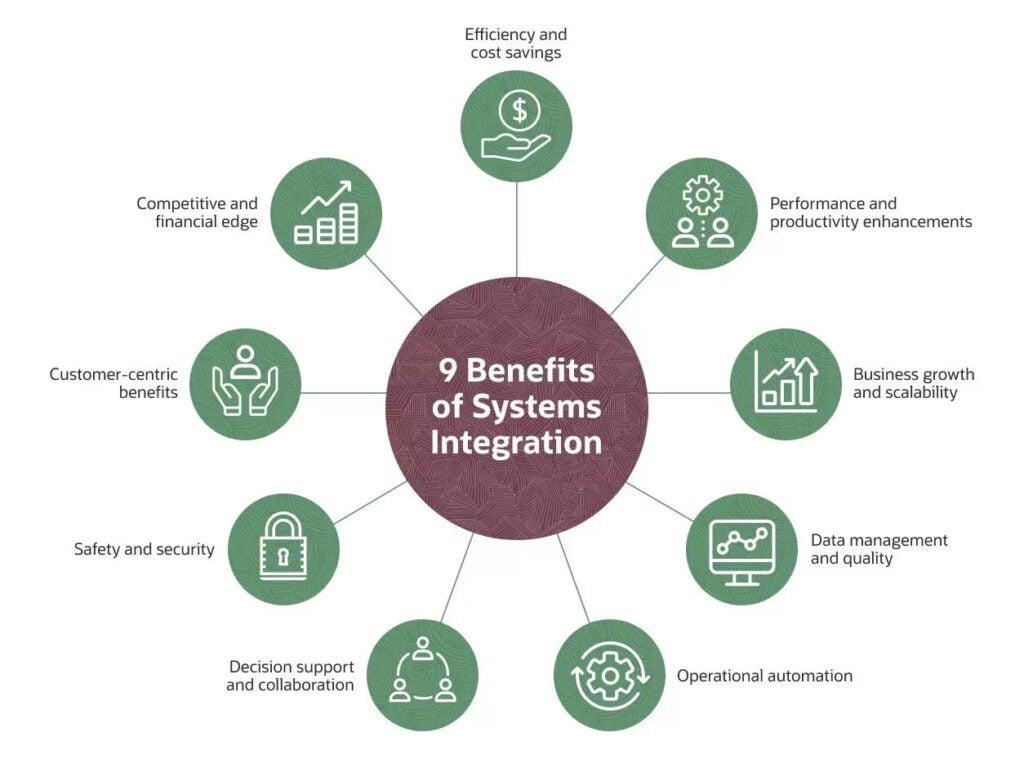

On the other hand, connecting two platforms has many benefits. It reduces the need to switch between apps, the information stays the same in both places, and you save time because you don’t have to enter it twice. Teams can access all the information they need from one place, respond to customers faster, and make decisions based on up-to-date, accurate data.

Image from NetSuite

You may be wondering: does Salesforce link to QuickBooks? And the answer is yes. The good news is you can connect QuickBooks to Salesforce, allowing the two systems to share information automatically. In this article, we will explain how to connect Salesforce to QuickBooks step by step. We are going to cover how to link the systems, move data between them, and keep your customer and financial records in sync.

Main Challenges of Connecting QuickBooks with Salesforce

While connecting Salesforce to QuickBooks Online can save time and reduce errors, the integration process is not always simple. According to a late-2024 Salesforce survey of 1,050 IT leaders, 95% struggle to integrate data across systems, and on average, only 29% of their business applications are connected. This is often because both platforms handle data differently, so bringing them together requires careful planning. To help understand the process, here are some of the most common challenges businesses face during integration:

Challenge 1: Different data structures

QuickBooks stores customer information in basic fields like name, email, and phone number. Salesforce organizes data using objects and fields, which can include more complex relationships. Because of this, you need to carefully match the fields so the information is correct in both systems.

Challenge 2: Deciding what to sync

Not all data needs to move between QuickBooks and Salesforce. You have to choose the important information, like invoices, payments, or customer notes. Sending too much data can slow things down, but sending too little can leave gaps.

Challenge 3: Limits of integration tools

Some integration tools have restrictions. They might limit how many records you can sync at once, how often syncing happens, or which types of data can move between the systems. Knowing these limits helps avoid problems later.

Challenge 4: Security and permissions

Both QuickBooks and Salesforce have sensitive financial and customer information. You need to make sure only the right people can see and edit the shared data. If permissions are set incorrectly, it could block access for the right people or expose data to the wrong users.

Challenge 5: Lack of skilled staff

Some businesses do not have people who know how to build a Salesforce QuickBooks connect setup. Without the right knowledge, the setup can take longer, cost more, and mistakes are more likely to happen. Or they may need to hire someone to build it, which is not cost-effective.

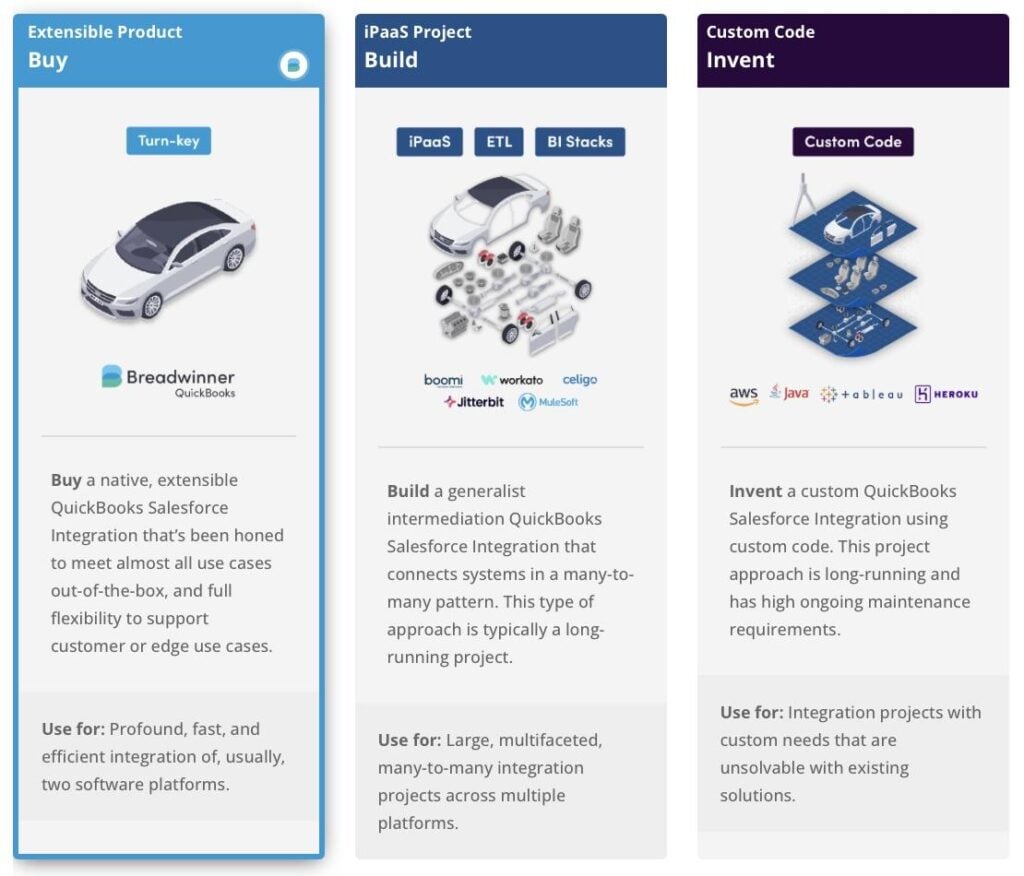

Possible Ways to Build the Connection

There are several ways to connect QuickBooks and Salesforce, depending on your business needs, technical skills, and budget. Each method has its own benefits and limitations. Below are the main options you can consider:

Possible Solutions, image from Breadwinner.

Middleware Platforms

Middleware platforms let QuickBooks and Salesforce share data automatically. You can choose which fields to sync, how often updates happen, and set rules for specific cases. Most connectors take anywhere from a week to a month to be set up properly, including mapping all the fields correctly. This option is often not the best choice for businesses that need a quick or simple setup because it can take a lot of time and effort to get it working correctly.

Custom API Integration

Custom integration uses the APIs of QuickBooks and Salesforce to build a connection from scratch. This gives full control over the data flow and lets you match the integration to your exact business processes. However, it requires technical skills and more time to set up, so it is usually best for larger businesses or unique requirements.

Pre-Built Integration Apps

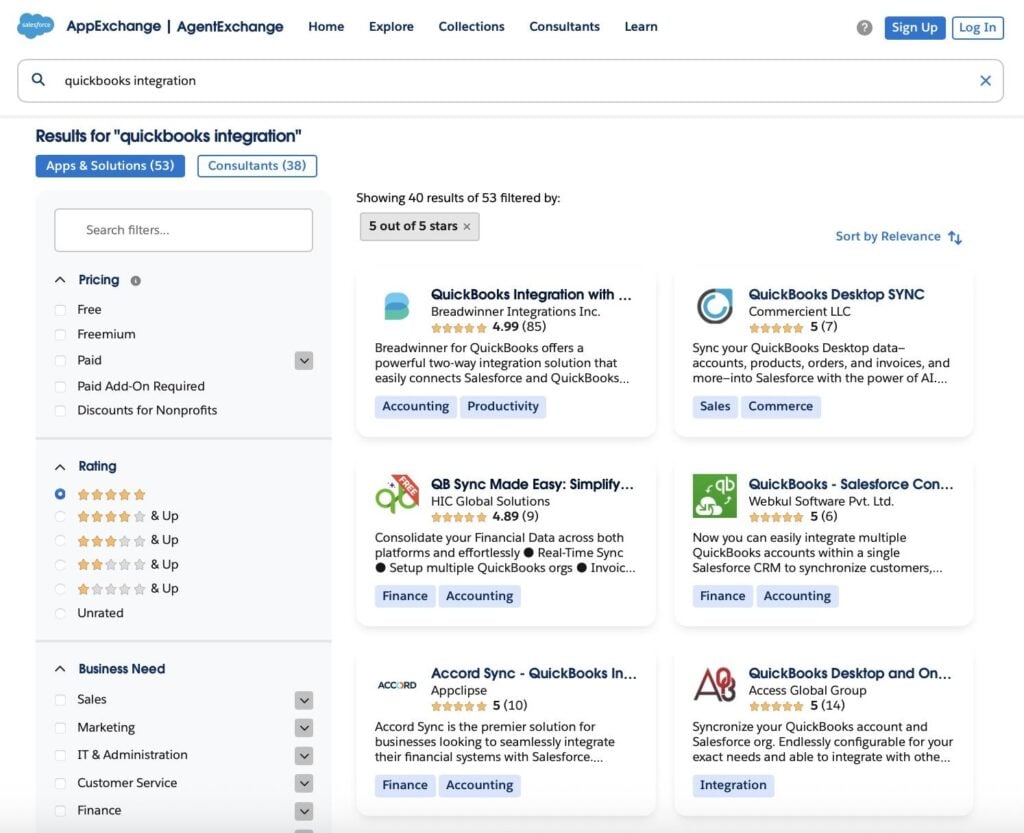

Pre-built apps are ready-made tools that connect Salesforce to QuickBooks automatically. They can sync invoices, payments, and customer information with minimal setup. These apps are usually easy to use and do not require technical knowledge, making them a good choice for small or medium-sized businesses. You can find many integration solutions on AppExchange. We chose Breadwinner App for its strong reviews and because it is a turnkey application that lets you complete the setup and map the fields in less than an hour.

QuickBooks Connectors on AppExchange

Steps to Connect QuickBooks and Salesforce

No matter which integration method you choose, you can follow these simple general steps to connect QuickBooks Salesforce. By following them, you ensure that invoices, payments, and customer records are accurately shared, making it easier to manage your sales and accounting processes.

- Choose the integration method: Decide whether you will use a pre-built app, a middleware platform, or a custom API integration. Your choice will depend on your technical skills, the complexity of your data, and how much control you want over the syncing process.

- Prepare your QuickBooks and Salesforce accounts: Make sure both accounts are active and have the necessary permissions. Check that all customer and financial data is complete and up-to-date.

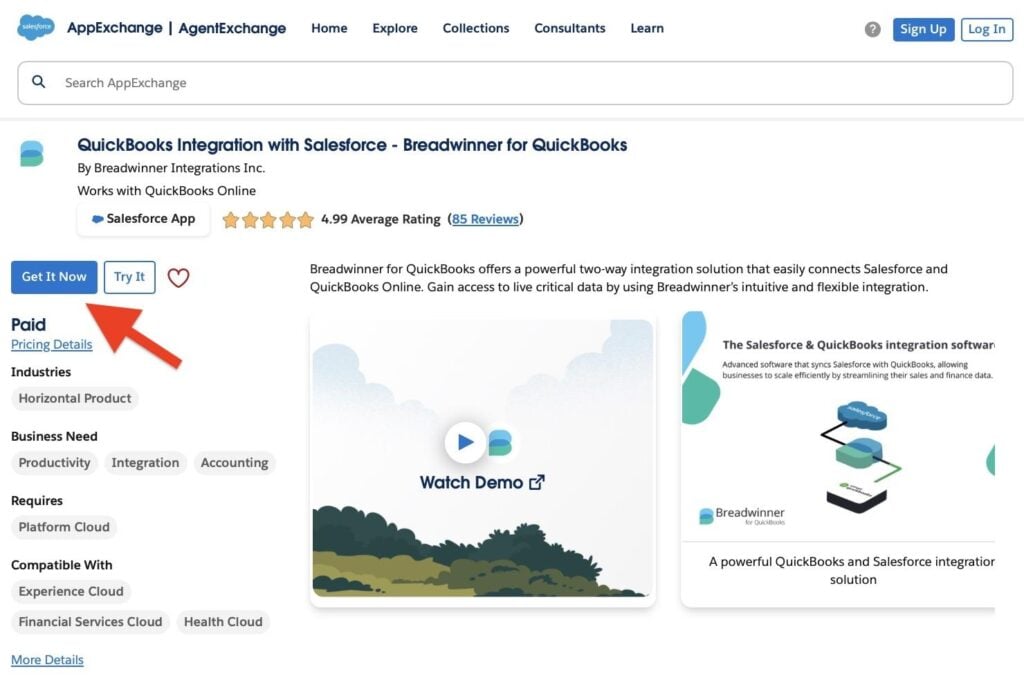

- Install and configure the tool: Follow the instructions for your chosen method. Pre-built apps usually guide you through setup, while middleware or custom APIs may require more time to configure rules and schedules. As an example for this article, we will use the Breadwinner connector for QuickBooks, which offers a fast setup and easy-to-use interface.

- Get the app: Go to the AppExchange and get the app.

Breadwinner on AppExchange

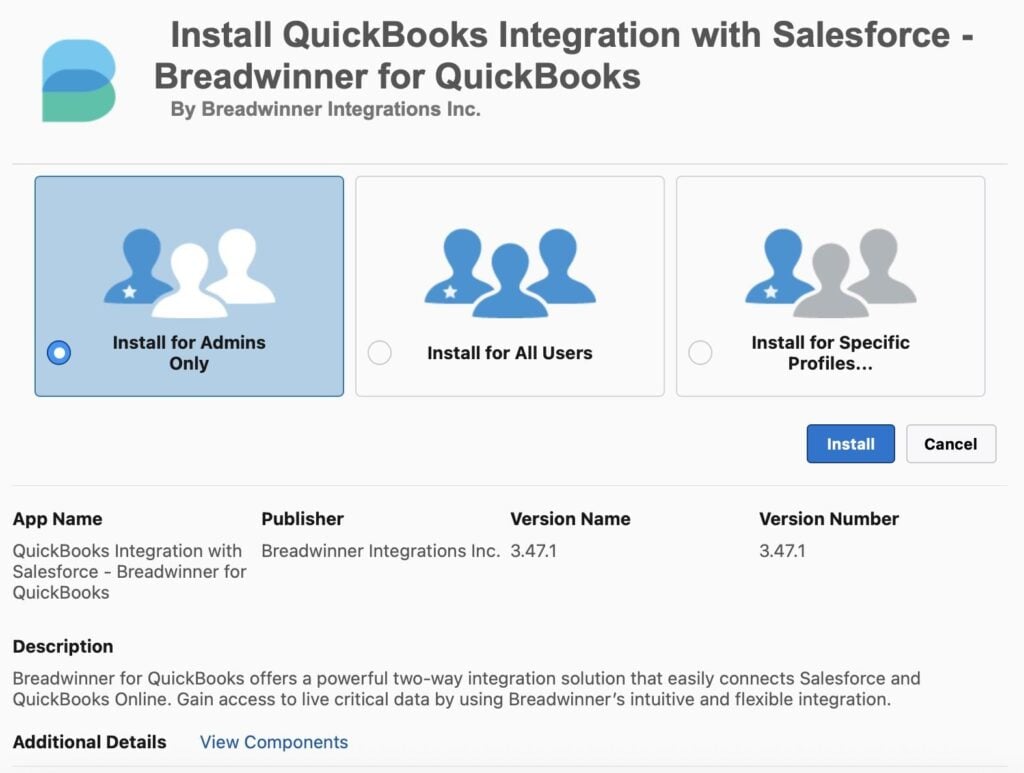

- Install the app: Follow the installation instructions provided by Breadwinner for your Salesforce and QuickBooks accounts.

Install Breadwinner QuickBooks for Salesforce

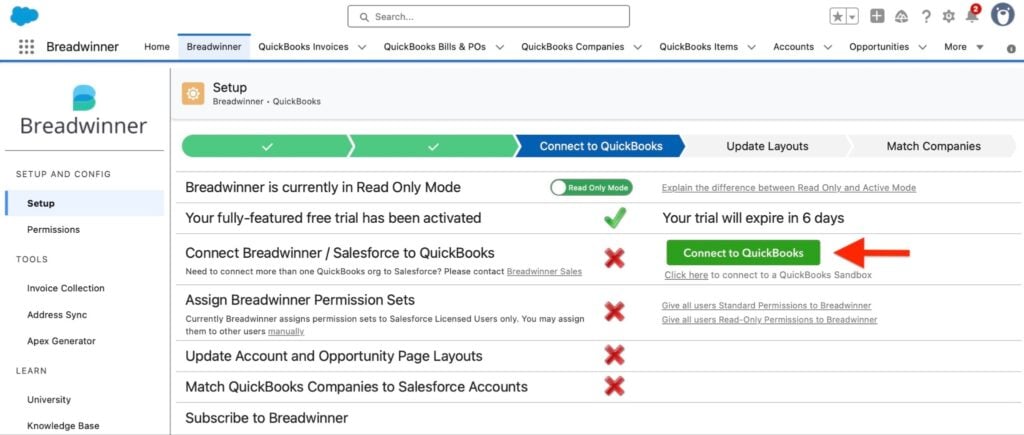

- Connect your accounts: Connect your QuickBooks and Salesforce through the app to link your accounts securely.

Connect to QuickBooks

- Configure settings: Set preferences for what data to sync, how often updates happen, and any custom rules you need.

- Map your fields: Identify which information should sync between the two systems. For example, match customer names, emails, invoices, and payment records so they correspond correctly in both QuickBooks and Salesforce.

- Test the connection: Before syncing all your data, run tests with a few records to ensure everything works correctly. Check that information transfers accurately and that there are no errors.

- Start syncing data: Once testing is successful, start syncing your full data. Monitor the first few days to confirm that updates are happening as expected.

- Maintain and monitor the integration: Regularly check that the connection is working and update mappings or rules as your business processes change. This ensures your QuickBooks and Salesforce data stay accurate over time.

Benefits of Connecting QuickBooks to Salesforce

Connecting QuickBooks and Salesforce brings financial and sales data together in one place. This integration helps teams work more efficiently, reduces manual effort, and ensures that data is consistent and accurate across both systems. With the right setup, businesses can use automation, create better reports, and improve how their teams handle daily tasks.

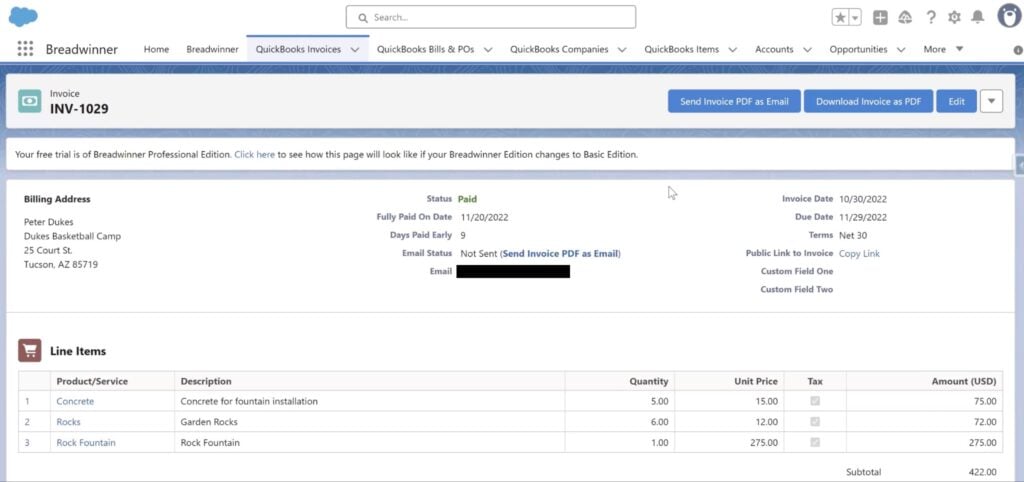

Access QuickBooks Data Directly in Salesforce

Having data from QuickBooks available natively in Salesforce means your team doesn’t need to switch between platforms. Customer, invoice, and payment information is visible directly in Salesforce, making it easier to manage accounts and track activity in one place. Some integration tools, such as Breadwinner, make this possible by bringing QuickBooks data into Salesforce as native records, so it can be used in reports, dashboards, and workflows without extra steps.

QuickBooks Invoices in Salesforce

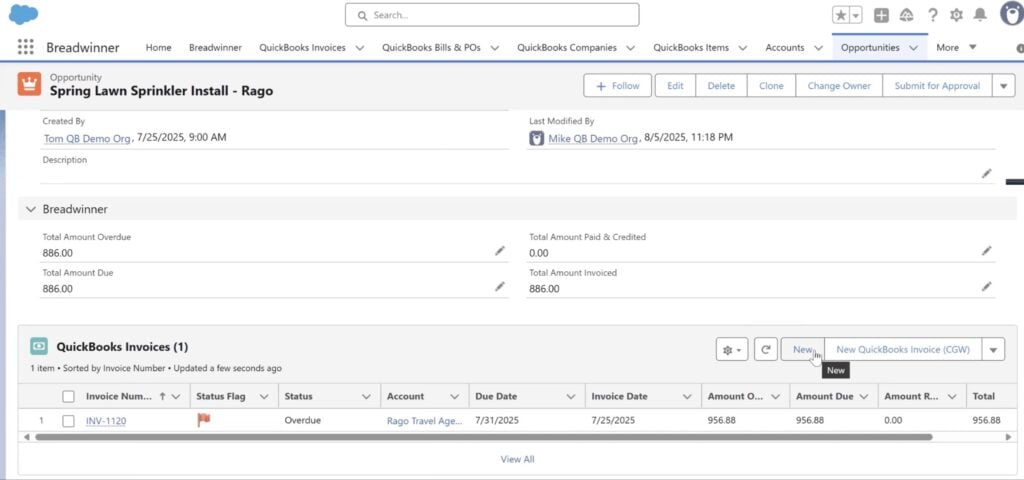

Create Invoices from Salesforce

With a tool like Breadwinner, users can create invoices directly from anywhere in Salesforce, for example, from an opportunity, and they will automatically appear in QuickBooks. This eliminates duplicate work, ensures accuracy, and speeds up the billing process.

Creating a QuickBooks Invoice from an Opportunity

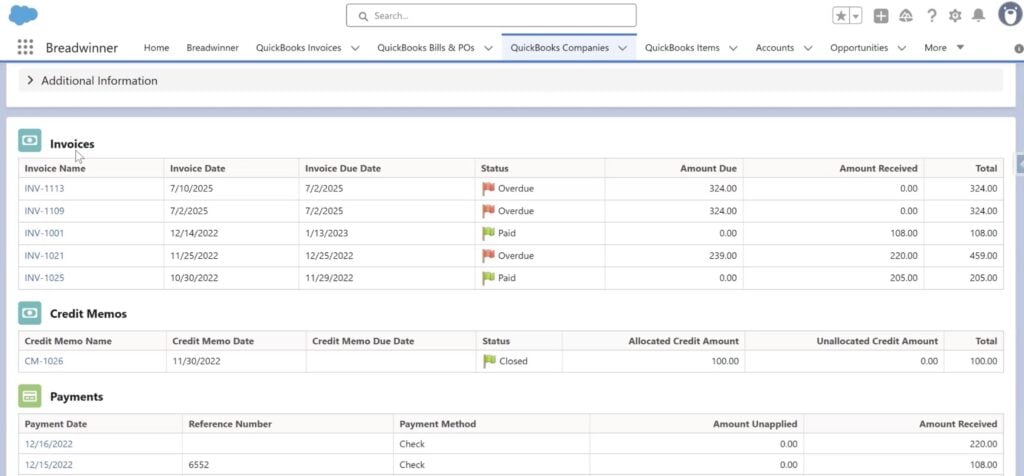

Keep Data in Sync

Regular syncing between QuickBooks and Salesforce ensures that both platforms have the same updated information. This consistency allows teams to trust their data, whether they are generating reports, running dashboards, or using it in automations like flows. For example, in Breadwinner, the default sync time is 15 minutes, but you can customize the interval to match your business needs.

QuickBooks Companies in Salesforce

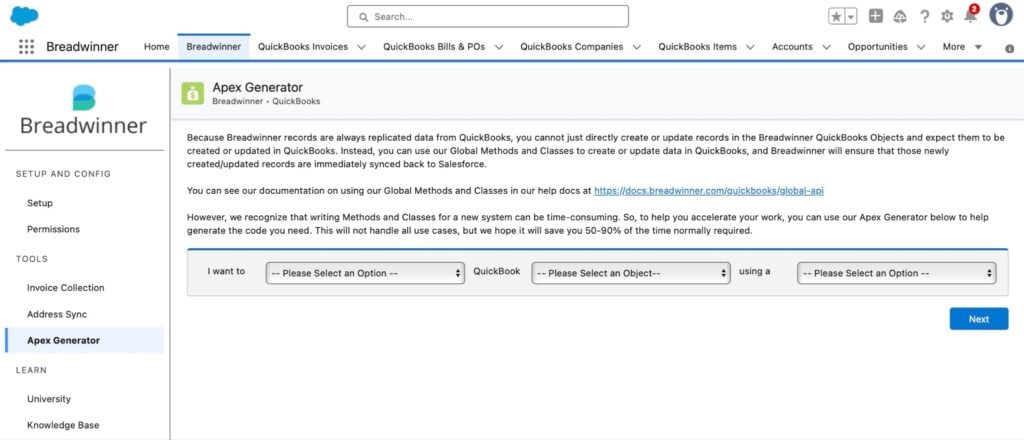

Advanced Customization

For businesses with specific requirements or logic, the integration can be customized using APIs. Some apps can only be used as they are, but tools like Breadwinner allow advanced customization to meet unique workflows or business rules, giving flexibility while keeping the core connection intact.

Breadwinner Apex Generator

Use QuickBooks Data in Reports, Dashboards, and Automations

With QuickBooks data available in Salesforce, teams can leverage it in reports, dashboards, and automation processes. With a connection like the one Breadwinner provides, QuickBooks data becomes native in Salesforce, meaning it behaves like standard Salesforce records. Because of this, you can use the data directly in flows, alerts, reports, dashboards, and other processes without manually transferring information.

Agentforce Ready

With a tool like Breadwinner, QuickBooks data becomes native in Salesforce, and it can be used directly by tools like Agentforce. This means you can run AI-powered analyses, create automated workflows, or generate insights using complete and accurate financial and customer data without needing extra steps or data transfers.

Save Time and Reduce Errors

Automating the data transfer between QuickBooks and Salesforce saves time and reduces mistakes. Teams no longer need to enter the same information twice or switch between platforms, which speeds up daily tasks and lets staff focus on more important activities like customer service, sales, or financial analysis. Automatic syncing also ensures that invoices, payments, and customer records stay accurate and consistent across both systems, reducing the risk of errors or miscommunication.

Wrapping Up on QuickBooks to Salesforce Integration

Integrating QuickBooks with Salesforce brings financial and sales data together, saving time and reducing errors. To make the integration work correctly, it is important to prepare accounts, install the tool, map the fields, test the connection, sync the data, and monitor the results. Taking these steps carefully helps avoid mistakes and keeps both platforms aligned.

Among all available solutions, pre-built apps like Breadwinner stand out for their fast setup, guided field mapping, and reliability. These apps allow teams to access QuickBooks data directly in Salesforce, create invoices from anywhere, and keep information in sync automatically. The integration also lets teams use data in reports, dashboards, automations, and it allows AI tools like Agentforce to work with complete information.

By looking to connect Salesforce to QuickBooks online, businesses reduce manual work, avoid duplicate data entry, and ensure information is accurate in both platforms. Teams can rely on up-to-date records, work faster, and spend more time on activities that directly support customers and sales. The integration also makes it easier to manage financial and sales operations in one place.